The Numbers Game

At a national conference last year on the genuinely worrisome problem of the federal deficit, Michael Dukakis, the Democratic presidential candidate and governor of Massachusetts, denounced the "scandalous gap between our tax laws and compliance with those laws."

The problem, he said, "is that tax compliance is declining at an alarming rate. Twenty years ago, according to the Internal Revenue Service, the tax compliance rate in the United States was approximately 94 percent. Last year, our tax compliance rate in the United States had dropped to approximately 81 percent, which means that as of this moment one out of every five Americans isn't paying the taxes he owes."

Dukakis added that "the difference between a 94 percent compliance rate and an 81 percent compliance rate is $65 billion a year in revenue."

It was a dramatic, eye catching statement, especially useful for a liberal politician who wants to establish himself as a frugal tough-minded manager, one who also has sought to make stronger tax enforcement an important part of his bid for the White House.

The law and order tax rhetoric offers the governor many political benefits. If the federal deficit actually could be brought under control with tougher tax enforcement, then there obviously is no need to propose an unpleasant tax increase. Neither does he have to grapple with genuine budget cuts that might irritate important Democratic voting blocks such as labor, the elderly and the contractors who build the nation's highways, airports and government offices.

The tax compliance issue, however, has a lot more going for it than just providing one Democratic presidential candidate an advantageous political position. If Dukakis's numbers are correct, they also provide the right thinking people of America with yet another indication of the nation's continuing moral collapse. This conclusion, of course, is pretty hot material for authoritarians of every stripe who feel the country must be shaped up, regardless of the cost. It is even better for those who believe that the Internal Revenue Service, already the single most powerful civilian agency of government, must be provided additional agents, more computers and increased legal sanctions.

But Dukakis's numbers were just plain wrong. They were wrong first because he had misquoted the IRS. They were wrong second because the IRS statistics themselves are at best questionable.

The IRS has several different methods of trying to determine who is paying, and not paying, taxes.

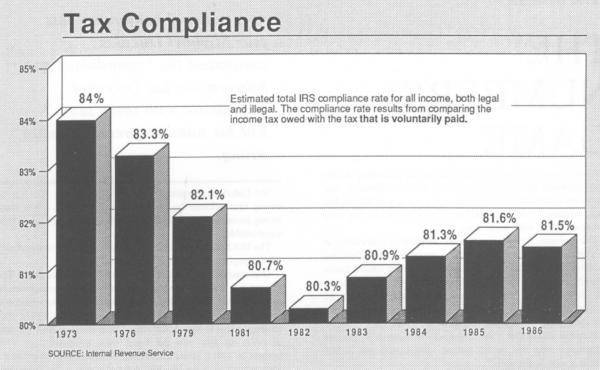

One measure is called the Tax Gap Compliance Rate. The tax gap rate is the percentage that emerges when an estimate of all of the taxes that the IRS believes should have been paid in a given year are compared with what was voluntarily paid. According to this measure, the compliance rate was 84.0 percent in 1973, the first year the "gap" was estimated, and 81.5 percent in 1986. Thus, the decline in compliance over the 13 year period covered by this technique was a far from precipitous 2.5 percentage points.

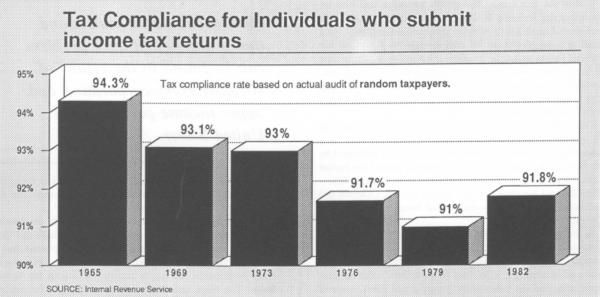

A second IRS measure is called the Taxpayer Compliance Measurement Program or TCMP. Under the TCMP, a random sample of tens of thousands of individuals and small corporations undergo special audits every few years. The first TCMP study estimated that in 1965, 94.3 percent of the citizens who were audited had paid the proper taxes. The last available TCMP audit, which covered the 1982 tax year, put the voluntary compliance level at 91.8 percent. The percentage change in the 17 year period covered by the TCMP once again was just 2.5 points.

Dukakis appears to have reached his wildly exaggerated but politically useful conclusion about the "alarming" increase in the failure of the American people to pay their taxes by comparing the highest point of' compliance identified by one IRS measuring technique with the lowest point estimated by an entirely different research method.

Ira A. Jackson, the Massachusetts Commissioner of Revenue, acknowledged in response to an inquiry that the governor's numbers had been incorrect. "What we have said subsequently is that the noncompliance rate is far too high," he said. "The governor's drift is that this problem has become increasingly serious and that it now is a ticking fiscal and political time bomb."

The governor, of course, is not the only politician entranced by the notion of solving the nation's deficit problems with stricter enforcement. Representative Byron Dorgan, a Democrat and former tax commissioner of North Dakota, also says the tax gap is growing at an alarming rate." Earlier this year, he put together a special task force, co-chaired by two former IRS commissioners, that called for a major new effort to improve the service provided by the agency while at the same time toughening its enforcement efforts.

While Dorgan seems to be somewhat more careful about his use of IRS statistics than Governor Dukakis, he does call his proposal a "painless way to raise over $100 billion in federal revenues." Like Governor Dukakis, Dorgan appears to be unaware of a 1986 IRS study which contradicts his thesis about the "alarming" growth in non-compliance. In fact, this latest official analysis said the most recent statistics show there has been "a small increase in the overall compliance rate" in the last few years.

The House and Senate committees responsible for establishing the overall federal budget goals and writing the tax laws also have viewed improved compliance as a kind of magic wand. And Congress, faced with the growing deficit of the last few years, has been happy to grant the IRS a fistful of new enforcement mechanisms and a major increase in agents by which to wave it.

The elected politicos, however, don't seem to be the only ones who see advantages in emphasizing, and sometimes exaggerating, the problem of non-compliance and the possible goodies to be gained by shaking the money tree more vigorously. For a long time, smart bureaucrats in all kinds of different enforcement agencies -whether it is robberies or environmental pollution -have understood that increasing "crime rates" can be very helpful when it comes to persuading legislators to give their agencies bigger bucks. The IRS has a good number of smart bureaucrats.

Is an analogy possible? For the last three decades, criminologists have cast a cautious eye toward the rapid increases in crimes reported to the police and published on a national basis by the Federal Bureau of Investigation. Partly because there have been repeated local scandals where departments in such cities as New York, Baltimore, Chicago and Philadelphia were discovered to be faking their crime statistics, social scientists wondered whether the national numbers were skewed.

This skeptical view of crime statistics was strongly reinforced a little more than a decade ago when the federal government started collecting a new set of crime figures by a statistical technique not controlled by the FBI and the police. According to this second approach, which is based on annual Census Bureau interviews with large samples of the American people, there has been almost no change in national crime rates during the last ten years.

Is it possible that senior IRS officials, who could use even a modest increase in "non-compliance" to help persuade Congress to grant their agency tougher penalties and bigger computers, might think about cooking the numbers?

Because of the IRS's quite successful effort to impose a blanket of secrecy around almost all of its operations -even those having no connection with the privacy protection of individual tax payers -it is hard to answer this question in a definitive way.

But even assuming the IRS has avoided the outright fraud found in the crime statistics of many police departments, there are many other questions that can be properly raised about the IRS's estimates concerning compliance with the tax laws.

One of the IRS's most thoughtful, persistent and well informed critics is Susan B. Long, a sociologist and associate professor of quantitative methods at Syracuse University. As a result of a lengthy series of suits brought by Long and her husband Philip, under the Freedom of Information Act, several of which had to be fought all the way to the Supreme Court, the Syracuse professor probably possesses more computerized data about the daily operations of the IRS than any single person outside the agency.

One product of her success in forcing the IRS to cough up the equivalent of more than a million pages of data, is a somewhat dated but still relevant analytic report published by the National Institute of Justice, a research arm of the Justice Department. Long's 1980 report did not have a catchy title -"The Internal Revenue Service: Measuring Tax Offenses and Enforcement Response" -but it did break important new ground.

In the analysis of the IRS's continuing effort to track the level of tax compliance, Long praised the TCMP random investigation method, calling it "a major and important advance in measuring a wide class of violations." But the professor also said she believed the program had flaws, some of them serious.

One key problem she uncovered during her analysis of the IRS data turned on the length of time that the agents took when they were conducting special TCMP audits. According to the previously unpublished IRS statistics uncovered by Long, the researcher found that during the ten year period covered by her study the time required to complete the average TCMP audit increased more than 80 percent -from 3.5 to 6.2 hours. Common sense tells us that the longer an auditor looks at a return the more problems will be spotted.

Further confounding the ability of the TCMP to accurately track long term compliance trends is the IRS acknowledgment that the special auditors chosen to undertake the work probably have become more proficient with time.

"Because of this increase in thoroughness and length of TCMP over time," Long concluded, "the recorded increase in tax underreporting may reflect changes in TCMP standards rather than any true changes in underlying noncompliance."

Yet another question raised by Long involves the basic statistical credibility that can be given an IRS agent's finding that Citizen Jones actually owes the government $500 more than he or she reported on the income tax return.

The professor notes that in real world cases outside the compliance measurement program where taxpayers have appealed the IRS's initial default findings, that "two thirds of these dollar claims were not upheld." Even when uncontested claims were added to the results after appeal, she added, "initial claims exceed the final corrected' amount by fifty percent or more in recent years. Further, it appears that many taxpayers agree to the initial auditor findings not because they believe the auditor was correct, but because of the cost or bother of an appeal, fear of the IRS or lack of understanding."

The questions are simple. First, are the initial assessments adjudged by IRS agents during the normal course of business reliable or highly exaggerated? Second, if field agents are inflating their assessments, are the agents chosen to make the periodic TCMP audits unconsciously or consciously doing the same thing? Does this array of various problems mean that the IRS's overall estimates of unpaid taxes is false?

The underlying problem here is the incredible complexity and ambiguity of the thousands of pages of tax laws and their supporting regulations. Most accountants understand that a non-compliance problem can be found in the return of virtually every corporation and upper income person in the United States. The black and white judgments that can be reached about most murder cases are impossible when considering a large proportion of the situations that lead the IRS to decide a taxpayer has not complied with the law. Because of the range of subtle and surprisingly judgmental decisions that go into the classification process, the TCMP audits sometimes may be influenced by outside pressures.

Sue Long does not contend that compliance with the tax laws has increased or decreased, only that the IRS's best statistical effort to prove the case has so many procedural flaws that the changes reported by the TCMP during the last two decades are not necessarily a reliable guide.

The important question of tax compliance is not the only area of tax administration that requires more careful analysis by the nation's political leaders and the voters.

For many years, for example, top IRS officials have repeatedly told Congress that they were the only federal agency that made money. Just give us more enforcement dollars, they said, and we will give you more revenue. The equation used to support these statements was a simple one: divide all the funds Congress provided the IRS into all the revenue collected by the agency. In 1986, Congress gave the agency $3.8 billion and it, in turn, brought in $782 billion in taxes. The agency's latest annual report thus calculates that $100 in revenue was brought in for every 49 cents spent on tax collection.

These numbers are a good example of the paradox about just how misleading an accurate statement sometimes may be. This is because the money voted by Congress each year for IRS agents and equipment to collect the revenue actually is only a relatively small part of what the nation spends collecting taxes.

During the last few years, Cedric Sandford, a political economist at the University of Bath in England, and Joel Slemrod, an economics professor at the University of Minnesota, have undertaken two entirely separate research efforts to measure some of these other costs.

With the cooperation of Inland Revenue, the British equivalent of the IRS, Sandford sent a sample of more than 4,000 taxpayers a questionnaire about their marital and employment status, the number of dependents, amounts and sources of income, the amount of time spent preparing returns and any fees paid for tax advice. In cases where individuals prepared their own returns, Sandford valued that time at the average hourly rate of their earned income.

The Inland Revenue's "administrative cost," the equivalent of the IRS's annual appropriation, was 691m pounds during the 1983-1984 tax year.

But on the basis of 1,776 usable replies, Sandford has concluded that the out-of-pocket costs to the British public for preparing individual income and capital gains tax returns---considering both personal time and the fees paid to accountants -was about 1,066m pounds. In addition, he estimated that British corporations spent another 400 million pounds in the collection of the British version of America's withholding tax.

Thus, Sandford concluded that the actual costs of collecting the income and capital gains taxes in Great Britain were well over 2b pounds, or three times more than the tax agency's budget.

At the University of Minnesota, Slemrod, and Nikki Sorum, a research associate, sent a four page questionnaire to a random sample of 2,000 Minnesotans immediately after April 15, 1983. The questionnaire sought information about the age, sex, income and employment status of those living in each household and the time and expense of preparing the necessary returns.

Slemrod fully acknowledges his survey had certain shortcomings. Is a sample of Minnesotans representative of Americans in general? Were the 600 people who provided usable replies specially motivated for one reason or another? What is the proper value to place on a taxpayer's time?

Thus, while the economist does not claim the survey is perfect, he does feel it has a rough validity. On the average, Slemrod projects that the typical household in the United States spent about 21.7 hours of its own time preparing the 1982 income tax returns. If the social cost of this work is assumed to be the tax payer's hourly rate of compensation -after taxes -the time spent by the average household would be valued at $231. But a large number of households also require professional assistance, which he found involved an additional average payment of $44. Slemrod thus calculates that it cost the typical American household a total of $275 to complete the 1982 tax return.

Assuming the rough accuracy of the survey, and projecting it for the entire United States, Slemrod concluded that the one year expense of paying taxes -not counting the IRS budget and the corporate expense of collecting withholding taxes -was somewhere between $17 and $27 billion. The IRS's 1982 budget was $2.6 billion.

There is no suggestion in the research of either Sanford or Slemrod that because the actual cost of collecting taxes is far higher than generally thought, that taxes should not be collected. Implicit in their work, however, is the need for a great deal more careful analysis when a nation considers tax policy. One clear message is that complexity costs society a great deal more money than generally is assumed. This means that genuine tax simplification also could have major economic consequences.

A parallel point can be made about Sue Long's research. Long's study of the IRS's attempts to measure compliance does not suggest that the failure to pay taxes is a trivial problem, but that care should be taken to avoid drawing unwarranted conclusions about imperfect measures.

Implicit in the work of all three researchers is the need for rigorous candor on the part of the IRS and much more serious examination of tax administration as an important part of the nation's overall tax policy. Glib sloganeering can be dangerous to the nation's economic health.